1

Derivatives Rollover Report | August 27, 2021

For Private Circulation Only

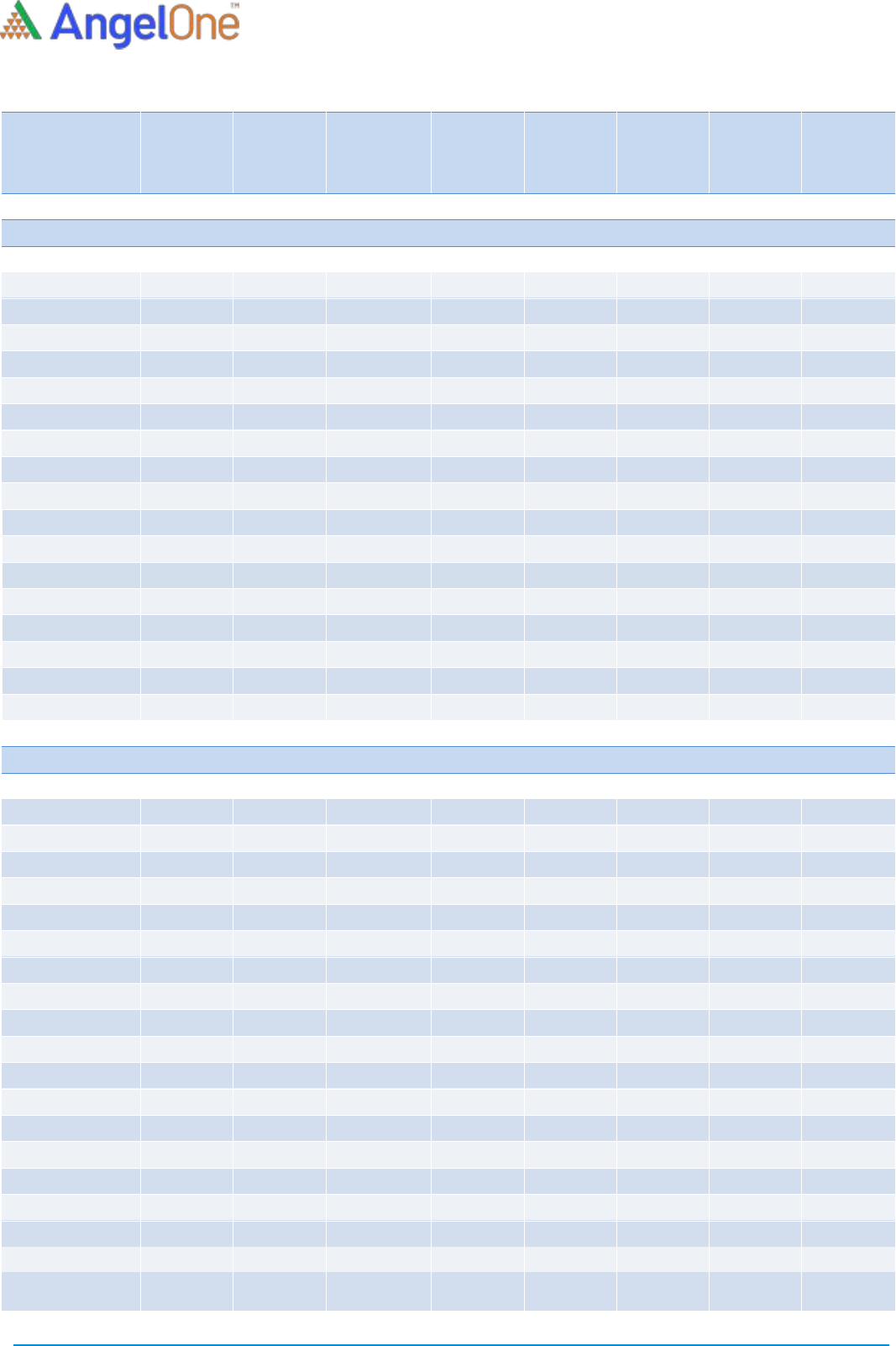

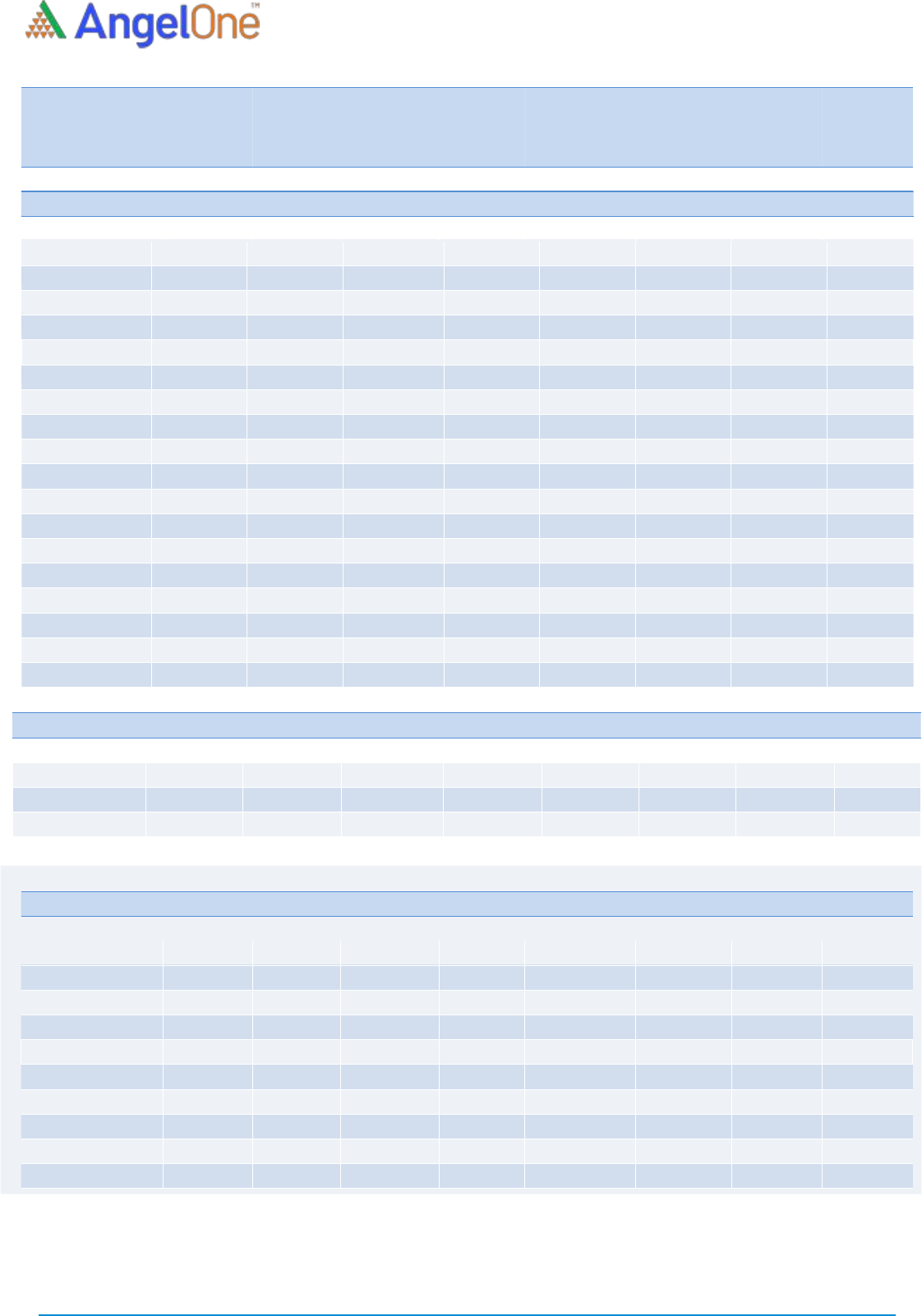

NIFTY & PCR Graph

Monthly Gainers

Scrip

Price

Price

Change

(%)

Open

Interest

Ol

Change

(%)

TECHM

1456.10

28.54

9270000

(42.82)

MINDTREE

3510.05

25.05

1713200

(21.90)

ESCORTS

1349.50

18.22

5835500

24.09

CUMMINSIND

985.35

17.74

2362200

6.38

APOLLOHOSP

4725.95

16.63

2105750

26.97

Note: Stocks which have more than 1000 contract in Futures OI.

Monthly Losers

Scrip

Price

Price

Change

(%)

Open

Interest

Ol

Change

(%)

IDEA

6.00

(27.27)

300160000

(21.41)

AUROPHARMA

702.00

(22.81)

17149600

68.74

MANAPPURAM

161.90

(22.57)

23166000

48.61

IBULHSGFIN

220.00

(21.15)

34456500

(5.32)

SAIL

115.00

(19.30)

135299000

(18.27)

Note: Stocks which have more than 1000 contract in Futures OI.

Indices Change

INDEX

Price

Price

Change

(%)

Rollover

3 month

avg.

NIFTY

16636.90

5.32

83.98

83.78

BANKNIFTY

35617.55

2.60

79.08

81.41

FINNIFTY

17441.40

5.62

67.74

75.84

-

-

-

-

-

-

-

-

-

-

After a consolidation phase in June and July series, Nifty confirmed a breakout to mark fresh record highs in the August series. The

index first surpassed the much awaited level of 16000 and then continued the momentum to end the series above 16600 with gains

of more than 5 percent over last expiry.

During the series, we saw long formation in the Nifty along with open interest addition of 5%; whereas the Bank Nifty witnessed

marginal open interest build-up. Now if we compare the open interest base at the start of the series, Nifty is starting the September

series with higher open interest compared to last series while the Bank Nifty is starting the series with a lower open interest. If we

take a glance at the data, Nifty has rallied due to long formation whereas Bank Nifty has seen a relative underperformance due to

short formations. The rollover in Nifty is at 84% which is in line with its 3-month average and for Bank Nifty this figure stands at 79%,

which is tad lower than its average. Hence, the above mentioned open interest data indicates that long positions in Nifty have been

rolled to September series while the shorts in the banking space have not been rolled to the next series. FII’s are starting with their

‘Long Short Ratio’ at 65%, in line with their previous series data. However, they have rolled good amount of their long positions

in stock futures segment.

The above mentioned data is optimistic and hints that we should see a continuation of the rally in the near term. It would be crucial

to see how positions develop in the BankNifty index hereon and any addition of fresh long formation in this space, it could take the

leadership in lifting the benchmark higher. For the near term, 16500-16400 is the immediate support range, while 16800 and 17000

would be the levels to watch on the higher side.

Derivatives Rollover Report

For Private Circulation Only

2

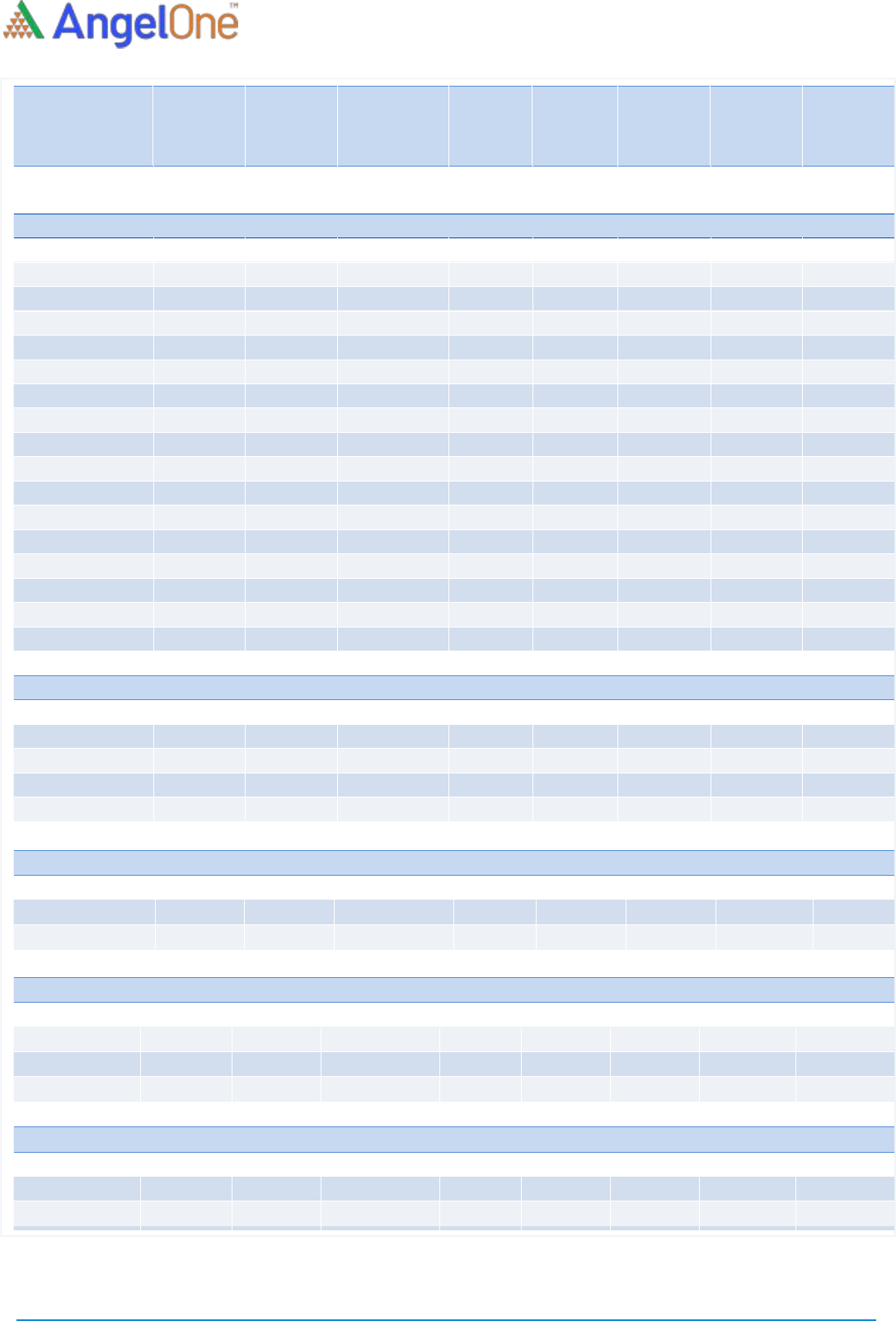

Scrip

Price

Price

Change

(%)

OI Futures

OI

Change

(%)

COC (%)

PCR-OI

Rollover

(%)

Average

Rollover

(3month)

(%)

AUTO & AUTO ANCILLARIES

AMARAJABAT

668.10

(4.12)

8877000

(11.40)

2.82

0.87

93.90

92.18

APOLLOTYRE

209.00

(3.82)

13565000

(0.75)

0.75

0.60

95.14

95.81

ASHOKLEY

117.40

(6.53)

35599500

21.39

-1.33

0.57

92.83

90.17

BAJAJ-AUTO

3698.75

(1.99)

2004250

13.52

2.08

0.62

95.25

90.20

BALKRISIND

2276.80

(1.71)

1202400

30.87

1.93

0.87

95.22

95.00

BHARATFORG

728.60

(7.57)

8637000

57.54

2.15

0.52

96.03

94.85

BOSCHLTD

13673.45

(8.56)

159550

38.62

1.86

0.64

95.23

97.43

EICHERMOT

2543.45

1.02

4116000

72.56

-14.28

0.43

96.48

94.60

ESCORTS

1349.50

18.22

5835500

24.09

4.93

0.42

95.42

95.97

EXIDEIND

157.65

(9.76)

24411600

63.79

2.32

0.81

93.08

94.18

HEROMOTOCO

2654.40

(3.57)

5139600

16.40

2.70

1.01

94.78

95.23

M&M

782.90

6.87

10780700

(0.21)

2.00

0.42

95.23

95.38

MARUTI

6637.10

(4.85)

3314600

27.04

4.50

0.65

97.03

95.22

MOTHERSUMI

212.20

(10.58)

30464000

26.04

-5.38

0.82

91.06

92.29

MRF

76777.15

(3.79)

45350

11.59

2.91

0.70

98.12

97.79

TATAMOTORS

284.90

(3.19)

105809100

0.26

2.20

0.60

96.58

92.98

TVSMOTOR

510.40

(9.40)

5394200

(7.56)

2.46

0.60

91.15

91.35

BANKING & FINANCIALS

AUBANK

1356.90

14.23

2130000

5.21

2.81

0.21

94.73

94.44

AXISBANK

747.90

3.92

26289600

(21.65)

2.17

0.68

98.52

96.34

BAJAJFINSV

16013.45

9.68

796200

(10.75)

3.58

0.51

83.97

85.36

BAJFINANCE

6959.95

8.42

4027500

(8.90)

4.20

0.59

92.78

93.97

BANDHANBNK

265.60

(9.51)

29143800

36.14

2.16

0.79

90.17

88.83

BANKBARODA

74.35

(8.21)

164080800

(2.94)

3.52

0.79

93.62

96.05

CANBK

153.55

2.37

61317000

2.59

4.78

0.75

82.99

90.03

CHOLAFIN

533.20

9.02

10166250

(15.49)

4.81

0.42

97.80

93.26

CUB

145.05

(3.65)

7241600

(20.73)

3.61

1.43

95.97

96.59

FEDERALBNK

78.35

(8.95)

80970000

(0.56)

2.00

0.69

95.51

96.42

HDFC

2708.10

11.91

12178200

(9.66)

2.99

0.54

96.13

94.54

HDFCAMC

2988.05

5.55

870000

(5.35)

3.64

0.74

97.91

95.70

HDFCBANK

1557.00

9.48

21657350

(27.96)

1.48

0.54

88.72

92.26

IBULHSGFIN

220.00

(21.15)

34456500

(5.32)

4.76

0.58

87.49

90.84

ICICIBANK

700.45

1.47

84506125

28.94

2.46

0.61

95.11

94.63

ICICIPRULI

654.95

2.50

5908500

2.39

4.96

0.50

96.07

93.38

IDFCFIRSTB

42.35

(18.71)

183093500

4.03

3.71

0.65

94.01

94.15

INDUSINDBK

1003.20

1.43

12221100

(21.18)

1.77

1.04

96.65

96.63

KOTAKBANK

1705.60

3.76

16214400

(9.81)

4.98

0.76

96.09

96.41

Derivatives Rollover Report

For Private Circulation Only

3

Scrip

Price

Price

Change

(%)

OI Futures

OI

Change

(%)

COC (%)

PCR-OI

Rollover

(%)

Average

Rollover

(3month)

(%)

L&TFH

81.50

(5.89)

57247460

(15.76)

3.85

0.64

94.71

94.64

LICHSGFIN

379.85

(8.76)

23888000

53.11

-17.28

0.66

94.40

92.37

M&MFIN

155.25

4.23

31428000

(27.69)

1.01

0.66

95.32

94.57

MANAPPURAM

161.90

(22.57)

23166000

48.61

3.23

0.61

92.41

89.52

MFSL

1027.50

(8.03)

3051750

23.91

3.10

0.36

97.85

96.67

MUTHOOTFIN

1490.40

(4.95)

2986500

(1.95)

3.51

0.62

93.74

94.32

NAM-INDIA

409.15

1.99

3585600

36.73

3.45

0.15

97.99

95.69

PFC

123.00

(4.02)

26474000

(13.28)

-13.80

0.73

90.05

94.13

PNB

35.95

(9.10)

283984000

(7.39)

4.37

0.87

94.06

96.03

RBLBANK

163.10

(15.10)

33550100

14.87

3.53

0.99

91.05

93.07

RECLTD

143.10

(4.60)

20514000

2.95

-7.24

0.96

88.21

88.60

SBIN

411.65

(7.18)

89601000

2.63

2.29

0.69

93.88

94.84

SRTRANSFIN

1270.35

(7.79)

4763200

26.49

4.04

0.49

97.49

91.43

CAPITAL GOODS & INFRASTRUCTURE

ADANIPORTS

725.05

9.51

86726250

3.04

4.84

0.49

98.62

98.23

BHEL

52.15

(13.73)

111079500

10.79

3.01

0.53

95.86

95.72

GMRINFRA

28.80

2.67

101002500

(7.19)

1.81

0.75

91.11

93.33

HAVELLS

1217.50

2.96

3996000

(5.82)

2.15

0.39

97.51

96.02

LT

1598.35

(0.18)

12513150

4.43

1.70

0.52

98.30

93.38

SIEMENS

2215.25

13.39

1811975

28.64

1.98

0.25

93.32

95.63

VOLTAS

959.75

(6.56)

3518500

16.76

2.56

0.59

92.35

#N/A

CEMENT

ACC

2280.15

(3.90)

2773000

(8.27)

2.13

0.44

96.27

91.08

AMBUJACEM

397.95

(2.56)

14175000

(6.14)

-1.05

0.50

84.97

79.63

GRASIM

1444.45

(6.42)

10269025

10.43

3.91

0.81

93.23

90.85

RAMCOCEM

968.40

(9.17)

1807950

5.98

-0.22

0.39

97.88

97.03

SHREECEM

26586.40

(4.24)

205825

22.17

1.17

0.29

97.70

91.48

CHEMICALS & FERTILIZERS

AARTIIND

905.55

0.99

2236350

(12.97)

-1.49

0.57

86.89

90.74

COROMANDEL

769.70

(11.32)

1346250

6.63

2.51

0.35

80.31

#N/A

DEEPAKNTR

2093.55

10.02

2754000

(6.05)

3.65

0.84

97.31

95.40

NAVINFLUOR

3603.25

1.85

408600

(14.22)

0.35

1.69

95.13

94.78

PIDILITIND

2232.35

(3.16)

2590000

38.24

2.20

0.53

97.31

91.53

PIIND

3148.55

6.82

928750

14.70

3.26

0.34

96.44

97.52

TATACHEM

828.20

9.84

10114000

15.02

2.02

0.49

95.43

95.41

UPL

722.25

(12.17)

24251500

4.19

3.77

0.76

96.28

94.69

Derivatives Rollover Report

For Private Circulation Only

4

Scrip

Price

Price

Change

(%)

OI Futures

OI Change

(%)

COC (%)

PCR-OI

Rollover

(%)

Average

Rollover

(3month)

(%)

Consumer Goods & FMCG

ASIANPAINT

3045.05

1.27

4835100

19.31

1.85

0.50

94.76

95.58

BERGEPAINT

788.20

(6.72)

4649700

33.05

2.19

0.50

96.51

92.70

BRITANNIA

3934.95

15.38

1320800

(24.26)

1.09

0.23

84.44

84.81

COLPAL

1659.55

(3.03)

2478000

24.63

3.28

0.43

96.51

96.21

DABUR

606.75

3.38

11140000

30.12

2.15

0.42

96.72

94.48

GODREJCP

1046.50

5.72

4838000

21.59

3.90

0.22

96.86

94.36

HINDUNILVR

2670.05

14.12

7107000

(1.03)

1.43

0.47

96.83

95.80

ITC

205.40

(0.68)

175952000

14.41

4.08

0.68

95.45

95.10

JUBLFOOD

3836.05

3.05

1624000

5.16

1.82

0.39

72.68

85.72

MARICO

524.90

(0.87)

10306000

58.26

5.79

0.40

94.59

94.47

MCDOWELL-N

687.95

7.53

14398750

8.68

5.41

0.41

97.57

97.16

NESTLEIND

20079.85

12.31

383200

23.63

1.42

0.37

97.47

97.62

TATACONSUM

855.25

13.49

7522200

5.19

2.38

0.33

94.84

94.39

TITAN

1823.30

4.50

4616250

(3.19)

4.57

0.61

96.28

95.43

UBL

1439.55

1.58

1438500

(4.33)

2.87

0.58

92.44

95.16

METALS & MINING

COALINDIA

134.45

(5.42)

56817600

3.91

-21.65

0.71

93.33

90.13

HINDALCO

424.60

(6.88)

35879200

(5.61)

1.23

0.60

86.72

86.87

JINDALSTEL

371.55

(15.17)

35477500

(9.18)

0.84

0.55

95.33

96.81

JSWSTEEL

673.35

(10.35)

46399500

4.97

2.10

0.50

97.55

96.51

NATIONALUM

79.00

(15.24)

68799000

(12.95)

2.65

0.62

76.11

87.95

NMDC

150.15

(18.22)

62162600

(40.53)

11.23

0.82

63.39

82.28

SAIL

115.00

(19.30)

135299000

(18.27)

-2.26

0.59

84.84

90.46

TATASTEEL

1377.50

(5.71)

41698450

(4.15)

1.90

0.61

97.27

94.89

VEDL

288.95

0.03

126889200

8.70

5.08

0.68

95.25

96.93

INFORMATION TECHNOLOGY

COFORGE

4976.25

(3.33)

704800

27.36

1.62

0.23

88.23

85.87

HCLTECH

1169.05

15.82

16551500

3.92

1.43

0.52

85.09

89.74

INFY

1732.00

6.85

27789000

5.84

2.60

0.77

86.55

90.10

LTI

5160.65

11.08

665700

(10.11)

4.73

0.25

95.40

95.26

MINDTREE

3510.05

25.05

1713200

(21.90)

4.52

0.40

88.36

90.13

MPHASIS

2703.80

1.49

1111500

40.28

-14.98

0.29

75.08

80.66

NAUKRI

5817.25

11.39

928875

1.23

3.73

0.43

91.36

88.29

TCS

3679.30

14.69

8884200

3.81

2.12

0.77

87.38

92.49

TECHM

1456.10

28.54

9270000

(42.82)

4.75

0.66

83.99

91.36

WIPRO

630.35

6.34

27240000

(5.58)

2.32

0.55

96.66

95.28

Derivatives Rollover Report

For Private Circulation Only

5

Scrip

Price

Price

Change

(%)

OI Futures

OI

Change

(%)

COC (%)

PCR-OI

Rollover

(%)

Average

Rollover

(3month)

(%)

INFORMATION TECHNOLOGY

HCLTECH

564.00

(0.70)

22885800

(1.26)

8.14

0.58

98.56

96.78

INFY

730.55

3.77

24351600

(52.50)

2.86

0.74

55.98

79.52

MINDTREE

782.95

10.93

1041600

(14.29)

-15.63

0.59

93.13

93.37

NIITTECH

1606.65

6.68

578250

26.08

-2.03

0.46

89.76

82.99

TCS

2212.80

6.19

15671500

(17.22)

6.42

1.91

95.02

94.74

TECHM

775.75

1.00

15406800

8.21

9.05

0.65

96.29

97.15

WIPRO

249.90

3.65

18211200

(29.64)

-2.08

0.72

83.12

92.60

MISCELLANIOUS

ABFRL

201.20

(11.87)

9107800

15.53

4.42

0.65

94.47

#N/A

ADANIENT

1481.45

5.54

16376000

12.54

4.06

0.73

97.40

96.70

APOLLOHOSP

4725.95

16.63

2105750

26.97

5.67

0.56

86.12

84.51

ASTRAL

1977.10

#N/A

350625

#N/A

2.99

0.99

96.01

#N/A

BATAINDIA

1715.05

6.43

1756150

(9.39)

4.76

0.21

93.55

92.72

BEL

180.80

(4.39)

23415600

9.22

-2.88

0.53

90.07

89.91

CONCOR

655.30

3.59

7155414

(1.44)

3.59

0.58

93.26

90.23

CUMMINSIND

985.35

17.74

2362200

6.38

4.52

0.45

71.22

88.30

HDFCLIFE

700.10

5.46

21157400

1.77

1.87

0.55

95.97

92.54

ICICIGI

1476.55

(1.49)

1955000

50.62

3.83

0.36

97.79

92.66

INDHOTEL

138.05

(6.94)

7476300

20.57

3.03

0.84

90.90

#N/A

INDIGO

1750.10

5.84

2396000

(14.29)

1.40

0.36

97.32

95.05

IRCTC

2632.50

13.04

1805700

(1.44)

4.32

0.55

90.99

91.51

LALPATHLAB

3796.75

2.61

366500

(9.84)

-1.22

0.60

91.97

91.12

LTTS

3867.75

4.74

526800

15.48

3.50

0.17

94.71

86.91

METROPOLIS

2688.05

(12.81)

313800

12.39

0.06

0.60

95.15

#N/A

SBILIFE

1154.30

1.99

6034500

38.60

2.26

0.29

61.39

73.62

TRENT

946.45

3.27

1348500

30.89

5.59

0.12

96.77

96.75

MEDIA

PVR

1305.60

(4.32)

1671142

30.14

4.41

0.48

95.89

92.17

SUNTV

476.90

(12.82)

13038000

4.96

2.96

0.95

94.49

86.86

ZEEL

166.35

(16.60)

70401000

21.89

-10.55

0.87

94.54

91.95

OIL & GAS

BPCL

468.30

3.89

40674600

5.97

3.46

0.49

93.06

95.06

GAIL

143.25

3.80

32744800

(3.71)

4.39

0.61

96.86

95.19

GUJGASLTD

709.95

0.14

1788750

22.73

1.84

0.49

88.55

85.53

HINDPETRO

256.10

(3.23)

21365100

28.65

2.45

0.46

96.77

95.11

IGL

522.50

(4.63)

9117625

12.56

-3.68

0.69

91.41

88.25

IOC

105.75

2.92

49764000

(18.67)

1.48

0.81

95.32

92.48

MGL

1107.60

(0.33)

1664400

(30.81)

-9.70

0.92

97.13

96.26

ONGC

114.40

(0.09)

45876600

(5.65)

-10.38

0.42

91.27

84.03

PETRONET

228.00

5.85

19851000

(17.27)

1.83

0.58

96.92

96.57

RELIANCE

2234.50

8.55

32060500

(13.26)

1.89

0.45

92.34

94.20

Derivatives Rollover Report

For Private Circulation Only

6

Scrip

Price

Price

Change

(%)

OI Futures

OI

Change

(%)

COC (%)

PCR-OI

Rollover

(%)

Average

Rollover

(3month)

(%)

PHARMACEUTICAL

ALKEM

3868.25

15.76

394600

(26.57)

1.50

0.20

93.86

89.14

APLLTD

737.85

(5.64)

1788050

(14.33)

2.76

0.92

90.23

85.68

AUROPHARMA

702.00

(22.81)

17149600

68.74

4.40

0.54

93.96

95.74

BIOCON

341.55

(10.87)

17001600

(13.76)

1.68

0.87

91.99

94.39

CADILAHC

541.60

(5.64)

19685600

(14.77)

1.83

0.62

91.58

95.25

CIPLA

911.90

3.49

12201150

(4.16)

0.69

0.80

96.34

94.73

DIVISLAB

4867.00

0.43

2006600

3.95

4.37

0.62

95.82

92.81

DRREDDY

4521.80

(3.60)

3205375

(9.76)

4.24

0.91

96.07

96.82

GRANULES

327.55

(12.18)

11194100

26.84

3.83

0.38

89.67

86.34

LUPIN

939.50

(13.74)

10471150

48.82

2.28

0.70

93.60

90.80

PEL

2574.85

10.72

2806375

(12.57)

3.17

0.34

96.85

96.35

PFIZER

5709.10

(2.16)

218000

(44.91)

2.60

1.00

97.05

92.55

STAR

584.40

(22.13)

1957500

#N/A

4.75

0.72

93.76

#N/A

SUNPHARMA

763.35

8.52

34367200

(23.86)

3.84

0.63

96.48

94.29

TORNTPHARM

3055.20

0.59

721500

5.68

0.84

0.19

99.01

96.72

GLENMARK

512.65

(13.46)

8267350

7.25

-0.41

0.60

93.45

93.96

POWER

NTPC

110.00

(5.70)

59382600

6.12

-25.44

0.62

89.50

82.80

POWERGRID

171.40

2.02

24275816

(8.58)

-10.24

0.52

78.77

77.43

TATAPOWER

125.85

2.15

122593500

(2.35)

1.66

0.79

94.36

94.77

TORNTPOWER

475.15

4.72

2340000

(10.86)

4.41

0.14

97.81

96.97

REAL ESTATE

DLF

309.15

(9.10)

45312300

(2.31)

5.43

0.58

96.45

93.15

GODREJPROP

1469.10

(6.39)

1866800

11.27

2.74

0.38

94.69

94.82

TELECOM

BHARTIARTL

589.40

3.75

90547218

(9.18)

4.44

0.50

92.24

94.78

IDEA

6.00

(27.27)

300160000

(21.41)

17.68

0.64

62.60

70.59

INDUSTOWER

215.50

(3.08)

11998000

(22.57)

1.45

1.03

93.36

90.62

TEXTILES

PAGEIND

30606.85

(3.41)

80580

15.98

4.63

0.27

99.33

98.53

SRF

9117.50

15.10

616625

39.71

6.26

0.55

94.45

93.11

NTPC

140.85

3.57

63643200

46.15

6.51

0.42

74.18

71.71

Derivatives Rollover Report

For Private Circulation Only

7

Research Team Tel: 022 - 39357600 (EXTN - 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelbroking.com

For Derivatives Queries E-mail: derivatives.desk@angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor.

Angel Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations,

2014 vide registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other

regulatory authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any

compensation / managed or co-managed public offering of securities of the company covered by Analyst during the past twelve

months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any

investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this

document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in

the securities of the companies referred to in this document (including the merits and risks involved), and should consult their

own advisors to determine the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions

and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a

company's fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our

website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within

this document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this

material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise

from or in connection with the use of this information.